Assumable Mortgage Loan Information -

An Assumable Mortgage allows a buyer to assume the rate, repayment period, principal balance and any other attached conditions of the seller’s existing mortgage instead of shopping to find a new one. When rates are low, mortgages that are assumable are attractive to buyers who may have qualified for a higher rate.

There are 2 types of typical loans that have this key feature.

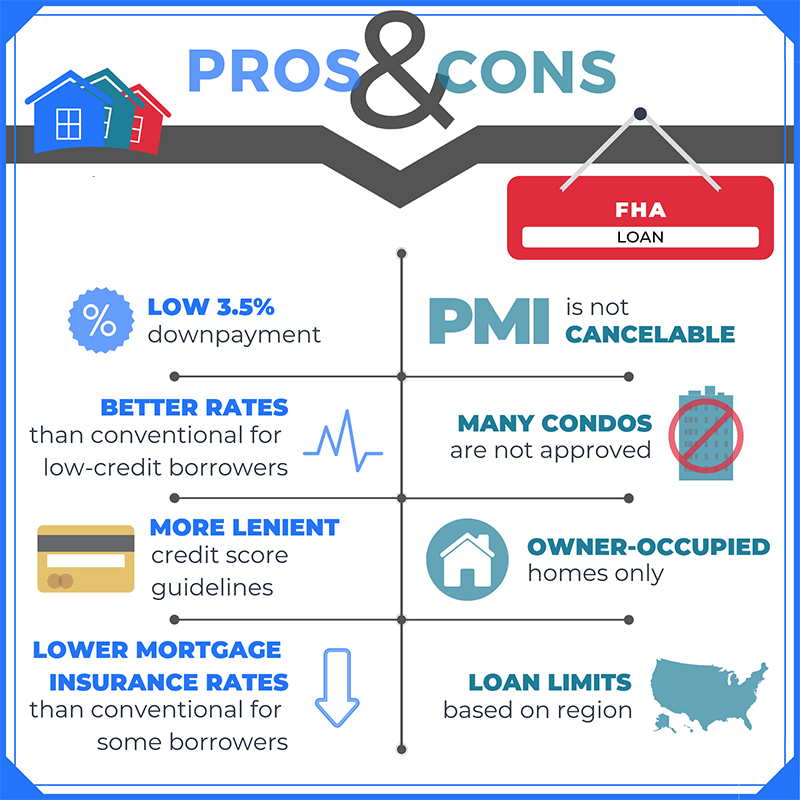

FHA Mortgage Loans that are insured by the Federal Housing Administration.

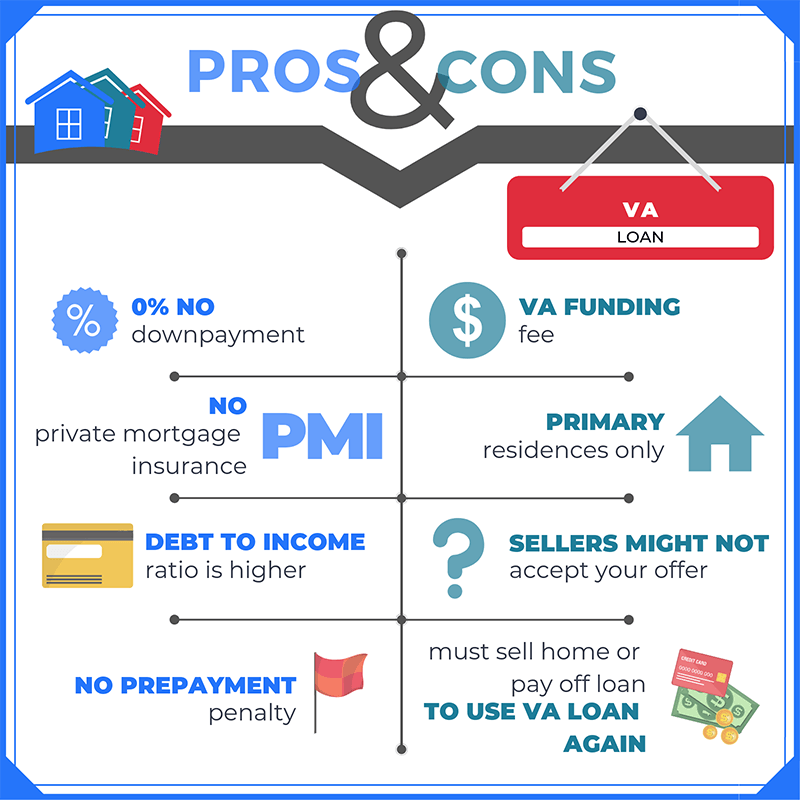

VA Mortgage Loans guaranteed by the U.S. Department of Veterans Affairs.

Borrowers who consider assuming an existing mortgage may find this option to be easier and less expensive than having to shop for new mortgage loans or rates. The only catch is that the buyer will still need to apply and qualify under the lenders requirements as if it were a new mortgage.

With an assumed mortgage, an appraisal, as well as the cost associated typically will not be required. The potential result is an easier deal to close and hundreds of dollars in savings. However, buyers do still have the option to independently order an appraisal to lessen the risk of overpaying for the property which could be in the thousands.

Sellers of Assumable Mortgages might still be responsible for the debt after the buyer assumes if the buyer does not make the required payments and there has not been a Liability release or if on a VA Loan the entitlement has been left attached.