Mortgage & Lender Info

Need To Know Mortgage Information For Real Estate Buyers:

If you are actively looking and are planning on buying a home, it would be a good idea to get pre-qualified or pre-approved for your mortgage loan before hitting the market.

What is the difference between being pre-qualified

and pre-approved?

Typically you will first pre-qualify for an amount that is affordable given the financial situation. Then, a lender will work get pre-approved after you have found the specific home you wish to purchase.

- Pre-qualification

is an informal determination by a lender stating how much you can afford.

- Pre-approval is a guarantee in writing by a lender to grant you a loan up to a specified amount.

Are there advantages of being pre-approved?

In a word, yes. There are two distinct advantages of being pre-approved for a loan as early as possible in your home purchasing process:

1. Sellers will find any offer you make more attractive if you are pre-approved for a mortgage. Most Sellers will not look at an offer without you being pre-approved.

2. The length of time before closing can be shorter if you’ve completed the steps to securing pre-approval prior to signing a contract on a property.

Selecting a Lender

When it’s time to select a lender, the goal is to obtain a loan with terms that are most favorable to your situation. In order to find the best home loan for you, contact several lenders to discuss the options they offer, their rates, closing costs, and other fees.

Loans are available from many sources, including mortgage companies, savings and loan institutions, banks and credit unions.

Applying For A Mortgage

When selecting a lender, your goal is to obtain a loan with terms that are most favorable to your situation. In order to find the best home loan for you, contact several lenders to discuss the options they offer, associated rates, closing costs and other fees.

For simplicity, many homeowners request to have their lender pay these related fees for them through an escrow account, wrapping them into each monthly payment. Regardless of whether you decide to go this route, or pay taxes and insurance directly, you should also factor these home related expenses into your budget.

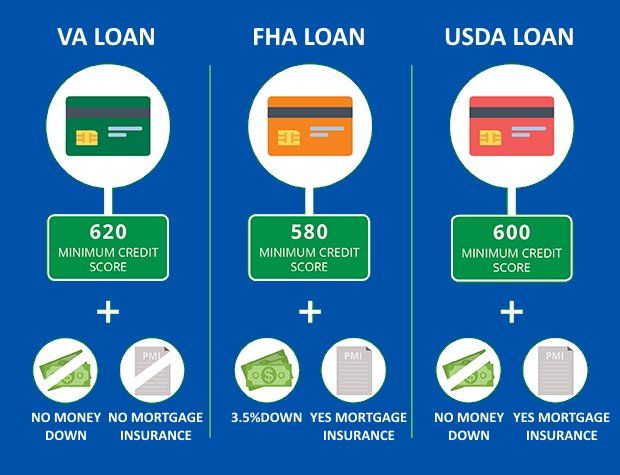

Your Credit Score Is IMPORTANT!

But there are options available for almost everyone.

First Time Home Buyer Checklist

When An Appraisal Is Too Low

The ABC's of Real Estate

Why should you work with a REALTOR®?

It's a common question that we hear a lot, but it can be simply summed up with 7 simple reasons that don't even include the money gains that you stand to earn from your real estate sales. REALTORS®

aren’t just agents. They’re professional members of the National Association of REALTORS®

and subscribe to its strict code of ethics. If you're considering purchasing or selling a home in Palm Beach County, Martin County, St Lucie County, or anywhere else in Florida, then you REALLY need a realtor for many other reasons not even mentioned below. There's a LOT more to it than most people realize, and the cost in time, money & energy to you for not having a REALTORS®

can be staggering!

This is the REALTOR® difference for home buyers:

This is the REALTOR® difference for home buyers:

- An expert guide.

Selling a home usually requires dozens of forms, reports, disclosures, and other technical documents. A knowledgeable expert will help you prepare the best deal, and avoid delays or costly mistakes. Also, there’s a lot of jargon involved, so you want to work with a professional who can speak the language.

- Objective information and opinions.

REALTORS®

can provide local information on utilities, zoning, schools, and more. They also have objective information about each property. REALTORS®

can use that data to help you determine if the property has what you need.

- Property marketing power.

Property doesn’t sell due to advertising alone. A large share of real estate sales comes as the result of a practitioner’s contacts with previous clients, friends, and family. When a property is marketed by a REALTOR®, you do not have to allow strangers into your home. Your REALTOR® will generally pre-screen and accompany qualified prospects through your property.

- Negotiation knowledge.

There are many factors up for discussion in a deal. A REALTOR®

will look at every angle from your perspective, including crafting a purchase agreement that allows you the flexibility you need to take that next step.

- Up-to-date experience.

Most people sell only a few homes in a lifetime, usually with quite a few years in between each sale. Even if you’ve done it before, laws and regulations change. REALTORS®

handle hundreds of transactions over the course of their career.

- Your rock during emotional moments.

A home is so much more than four walls and a roof. And for most people, property represents the biggest purchase they’ll ever make. Having a concerned, but objective, third party helps you stay focused on the issues most important to you.

- Ethical treatment. Every REALTOR® must adhere to a strict code of ethics, which is based on professionalism and protection of the public. As a REALTOR®’s client, you can expect honest and ethical treatment in all transaction-related matters.

When looking for homes for sale in Palm Beach County, Martin County and St. Lucie County, Florida Home Sales can help you find your ultimate dream home.

The best Stuart Realtor or Jupiter Realtor for Palm Beach County Real Estate or Martin County Real Estate - let Florida Home Sales work for you.

ABOUT FLORIDA HOME SALES

A experienced Stuart REALTOR, I cover all of St. Lucie County Real Estate, Martin County Real Estate and Palm Beach County Real Estate areas to help anyone sell their properties FAST or to help them find the new home of their dreams. When searching for a licensed Stuart Realtor who's going to work tirelessly for you and your family, look no further.

Designed & Hosted by IWANTAWEBSITE.com

LOCATION

3591 NW Federal Hwy, Jensen Beach, FL 34957

Licensed REALTOR

SL-3491448