VA Veteran Affairs Mortgage Loan -

VA Loans specific for Veteran’s are an amazing opportunity for real estate buyers purchasing a new home with $0 down and receiving an amazing interest rate.

Broken down into two basic types of loans with two options for each to customize specifically for your requirements and payment.

Fixed Rate Mortgage options for 30 year or 15 Year loans where home buyers can determine exactly how much to pay each month for the duration of the loan but pay a premium for predictability as the Fixed Rate Mortgage will typically cost more over the life of the balance.

Adjustable Rate Mortgage options where interest rates are lower, easier to borrow and help home buyers afford more but could have the opportunity to create a financial hardship if the new monthly payment rises above the budget of the home owner.

Eligibility Requirements of VA Loans

Determining if you are qualified to apply for a VA Loan is based on a few key factors.

Served 90 days consecutively during wartime.

Served 181 days consecutively during peacetime.

More than 6 years of service in the National Guard or Reserves.

Spouse of a service member who died in the line of action or from a service related disability

Major Benefits

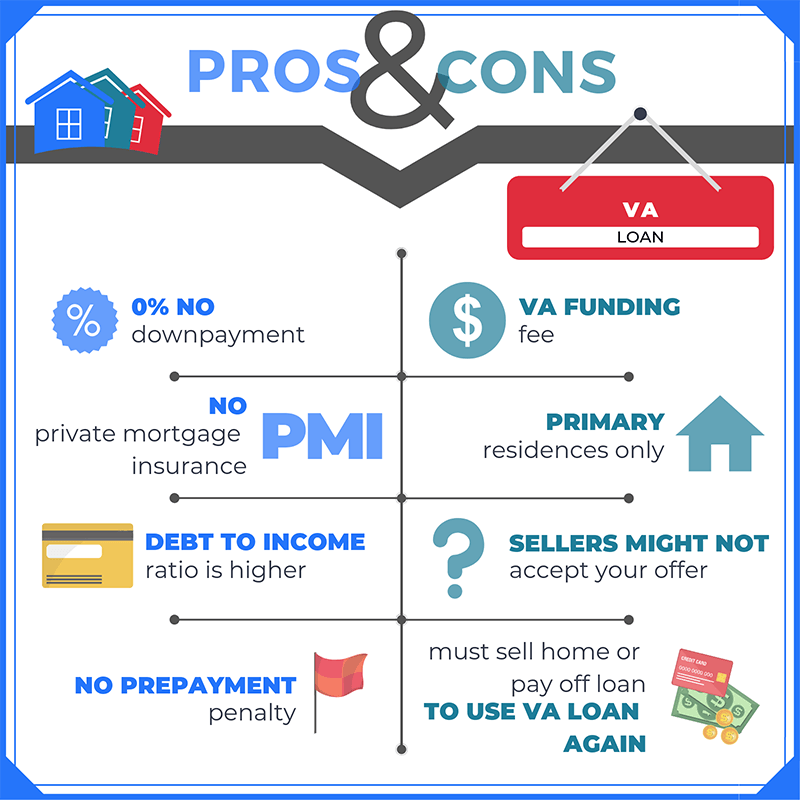

Savings! When choosing a VA Approved Lender, borrowers will not have to obtain PMI Private Mortgage Insurance which saves thousands.

No Down Payment is Needed

If you would like more information on using this mortgage option in the purchase of a new home, contact an approved lender for help getting set up. Then contact our Realtors® to find an approved home that will meet the underwriters requirements. After that, you will be on your way into the home you have always dreamed of!